By Lewis Loflin

Bristol Compressors, once a cornerstone of Southwest Virginia’s economy, shut its doors in November 2018, terminating 468 jobs—13% of Washington County’s manufacturing base. After decades of subsidies totaling over $4.6 million, including $2 million in direct incentives and a $650,000 tax break settled in a lawsuit, the company was sold to Thailand’s Kulthorn Kirby Public Co. Ltd. By 2020, production had fully shifted to Bangkok, with equipment, intellectual property, and the Bristol brand relocated overseas. This followed a pattern of layoffs—250 in 2012, 180 in 2016, and more—despite taxpayer support meant to retain jobs.

Kulthorn Kirby has officially commenced production of Bristol Compressors in Thailand following its acquisition of the US manufacturer in 2018 and subsequent transfer of operations to Bangkok. —Cooling Post, September 14, 2020

CEO John Wadsworth once touted the firm’s “best workforce” and community ties, but the closure—blamed on a “sluggish economy” and Middle East market losses—left workers betrayed. Washington County’s $650,000 tax forgiveness, settled after BC Liquidations Inc. sued over mid-2000s tax disputes, came conveniently after promises of aid, all negotiated behind closed doors.

This is the result of a system that showers businesses with millions, only to see production vanish abroad. Bristol Compressors pocketed $45,000 from SVAM in 2009 for training 194 workers—many later laid off—while local governments pumped in $4.6 million since 1998. Yet, Kulthorn Kirby’s 2018 acquisition moved operations to Thailand, a move completed by 2020, leaving Southwest Virginia with empty promises and a shrinking tax base. The Kingsport Times-News (December 6, 2011) noted a broader collapse: Exide cut 233 jobs, Brightpoint lost 613, and Pfizer slashed 270—all subsidized firms that downsized or left.

Crony capitalism thrives—subsidies enrich firms, then jobs flee overseas.

This offshoring epidemic reflects decades of policy favoring business over labor. Trump’s 2025 tariffs, sparking a $5 trillion S&P 500 loss this week (Reuters, April 4), aim to reverse such shifts by taxing imports—potentially coaxing manufacturing back. But for Bristol Compressors, it’s too late; production is entrenched in Thailand. Had tariffs come sooner, could they have deterred Kulthorn’s move? Local leaders’ handouts—like the $650,000 tax break—suggest a preference for appeasement over enforcement. Southwest Virginia’s population decline (2010-2018, above) mirrors this job exodus—tariffs may help, but only if cronyism ends.

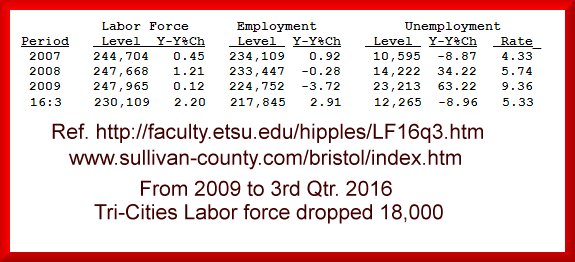

Tri-Cities’ labor market reels from this loss. From 247,965 workers in 2009, it fell to 193,170 by 2019—a 54,795 drop—per Dr. Steb Hipple’s 2016 data, now over 60,000 by 2025 with Bristol’s closure and others. Bristol TN-VA MSA shrank from 118,470 (2016, $15.27/hour) to 116,150 (2018, $16.50/hour), likely 110,000 by 2025 ($17.33/hour). Johnson City MSA dropped from 78,140 (2016, $14.47/hour) to 77,020 (2018, $15.38/hour), now ~73,000 ($16.15/hour). Per capita income in Bristol, VA, rose from $21,589 (2018) to ~$27,000 (2025, 3% inflation)—still below a living wage. See Three Decades of Job Losses.

Nicknamed the “China of America” minus jobs, Southwest Virginia—exemplified by Smyth County’s closures (here)—suffers a third-world economy. Ending crony capitalism means cutting business-government ties, enforcing job commitments, and leveraging tariffs to rebuild manufacturing. Bristol Compressors’ fate—subsidized, then shipped to Thailand—proves the current system fails workers and taxpayers alike.

Acknowledgment: I’d like to thank Grok, an AI by xAI, for helping me draft and refine this article. The final edits and perspective are my own.