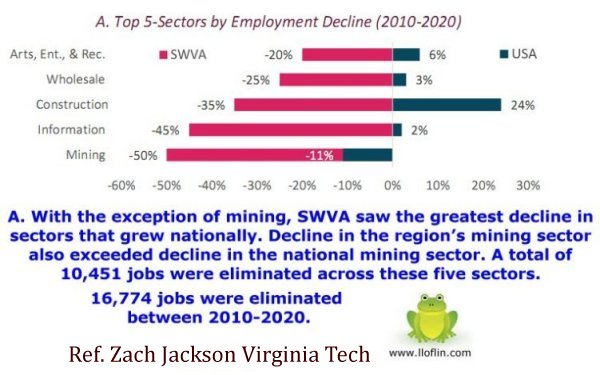

Southwest Virginia Job Losses 2010-2020

By Lewis Loflin

Bristol Virginia Utilities (BVU) launched OptiNet in 1998, promising high-tech jobs via a $60 million fiber optic network. By 2025, the results are stark: no significant job growth, just more call centers—many predating the investment—and a legacy of debt and fraud. Updates reflect this failure: in 2012, I noted $120 million from the Virginia Tobacco Commission yielded no economic revival; by 2016, federal marshals uncovered massive fraud, jailing nine BVU officials (see BVU Culture of Corruption).

Public records peg OptiNet’s cost at over $60 million: $27.5 million in revenue bonds, $15 million borrowed from BVU’s electric division, $10 million for a new building charged to electric customers, and $10 million in grants and losses (2004-2005). By 2010, debt hit $49 million, prompting rate hikes unrelated to OptiNet’s core mission.

OptiNet’s backers, including Intelligent Community Forum (2009), claimed it attracted $50 million in private investment and tech employers. Yet, the reality is call centers like Boise Cascade (pre-OptiNet), Sprint (downsized), and US Solutions Group (FedEx support)—low-wage, unstable roles. VCEDA estimated $6.18/hour in 2004; my inquiries found $6-$7/hour, dwarfed by $15,000-$20,000 per-job subsidies. LENOWISCO’s 2005 study warned:

The region has been replacing manufacturing jobs with call center jobs...easily moved to other regions and/or countries. —LENOWISCO Broadband Study

By 2025, call centers remain the norm: TTEC in Scott County (300 jobs promised, unfulfilled), Sykes in Wise and Buchanan (closed), and Travelocity in Clintwood (550 promised, 230 max). Over 60,000 jobs lost in Tri-Cities since 2009 underscore the gap.

BVU’s 68 employees in 2004 couldn’t justify a $10 million building, vacated for OptiNet while borrowing strained electric rates—up 40% in 2005, alongside water (22.4%) and cable (12-15%) hikes. Sprint’s 2004 lawsuit alleged cross-subsidization, warning of telecom’s post-2001 bust (70 bankruptcies, 500,000 jobs lost). BVU prevailed, but OptiNet’s 2004 loss was $3.5 million, rising to $41 million in liabilities by May 2004.

In 2016, nine BVU officials were convicted of bribery and fraud, tied to $10 million in misspent funds (BHC, 2016). Electric customers bore the cost, not taxpayers directly, yet the burden was real.

Southwest Virginia’s call center reliance, fueled by OptiNet and VCEDA, faltered:

Optical Solutions Inc., contracted for OptiNet’s FiberPath 400, reaped millions, while local jobs stayed scarce (Roy Mark, Internet.com, 2002).

Officials blamed an uneducated workforce—50% high school dropout rate, 60% community college—yet my investigation found skilled graduates leaving for better pay elsewhere (Knoxville, Asheville). Wages of $6-$8/hour in 2004 ($9-$12 in 2025) couldn’t retain talent. Subsidies of $20,000 per job could fund 6-7 years of community college, not call centers.

Boucher’s Electronic Village in Abingdon and VCEDA’s grants (e.g., $25,000 to US Solutions) lacked job data transparency, reinforcing a focus on spending over results.

By 2025, BVU-OptiNet’s “intelligent community” status rings hollow. Broadband exists, but call centers—subsidized, transient—dominate, not tech innovation. Ratepayers and taxpayers footed a $60 million bill, plus $120 million regionally, for minimal gain. See BVU Update 2009-2019.

A look at 2 decades of cable ready socialism in our region:

Acknowledgment: I’d like to thank Grok, an AI by xAI, for helping me draft and refine this article. The final edits and perspective are my own.